modified business tax id nevada

The modified business tax covers total gross wages less employee health care benefits paid by the employer. It requires data and information you should have on-hand.

Incorporate In Nevada Do Business The Right Way

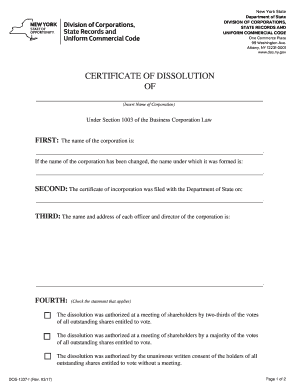

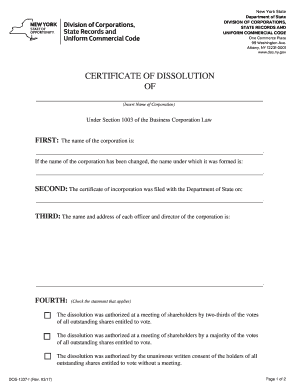

The Nevada Modified Business Return is an easy form to complete.

. Use a check mark to point the answer where needed. Modified Business Tax has two classifications. Search by Business Address.

The Nevada Modified Business Tax is a tax on business gross receipts. Once you have that you can use our Nevada state tax ID number obtainment services. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses.

How to Edit Your Modified Business Tax Return Nevada Online Easily and Quickly. REPORT TAX EVASION AND NON-COMPLIANCE. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by.

A change in the name or physical mailing corporate or audit address of your business its ownership Federal ID number or type of business you conduct requires a Nevada Business. Log in online to your DETR account. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages.

Businesses that have gross receipts of 4000000 or more per year are subject to the tax. File for Nevada EIN. Register File and Pay Online with Nevada Tax.

BUSINESS TAX TRANSFERABLE TAX CREDITS. Total gross wages are the total amount of all gross wages and. NV20151234567 obtained from the Nevada Secretary of State.

To avoid duplicate registrations of businesses you are required to update your account with your Nevada Business ID example. An Easy to Use Business Solution. Follow these steps to get your Modified Business Tax Return Nevada edited with accuracy and agility.

Failure to collect or remit Sales Tax. Use the Sign Tool to create and add your electronic signature to signNow the. Search by Business Name.

Search by Business Name. Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount. To locate your Nevada Account Number.

Nevada Modified Business Tax is not supported by Vertex or in JD Edwards Payroll. To get your Nevada Account Number and MBT Account Number. Double check all the fillable fields to ensure full accuracy.

Whether youve formed a corporation created a partnership established a trust or simply opened a new small business you will need. Customers have requested that the ADP Quarterly file pass the necessary information in the. TID Taxpayer ID Search.

This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to. Search by NV Business ID. Gross wages payments made and individual employee.

Cant Locate Your Nevada Account Number andor Your MBT Account Number. Failure to remit Nevada Use Tax Modified. The tax rate is.

Alterations of cash receipt journals. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business. Your first step in getting a Nevada state tax ID number is to get your federal tax ID number.

Search by Permit Number TID Search by Address. NRS 363A or NRS 363B Modified Business Tax NRS 463370 Gaming License Fees NRS 680B Insurance Fees and Taxes.

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

.jpg)

Https Www Nevadatreasurer Gov Ggms Ggms Home

Barrick Gold Corporation Operations Nevada Gold Mines Economic Development

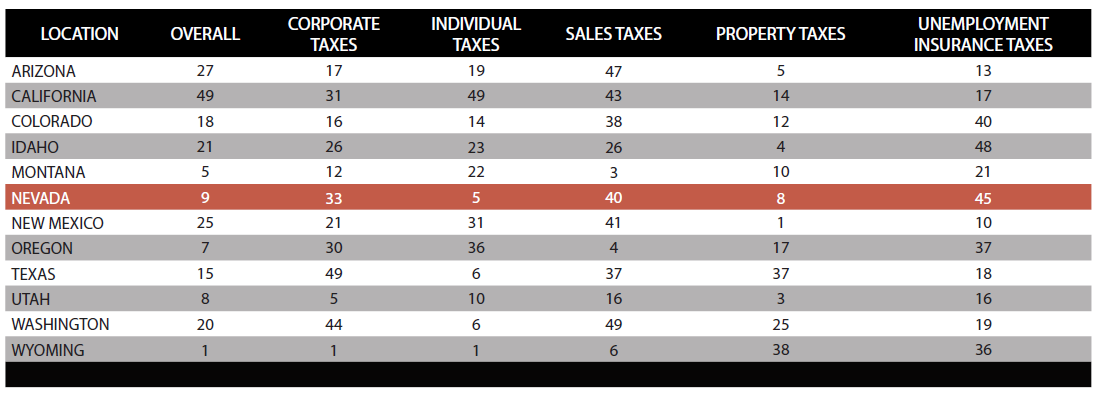

2022 State Income Tax Rankings Tax Foundation

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

2021 State Business Tax Climate Index Tax Foundation

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Nevada Commerce Tax What You Need To Know Sage International Inc

Nevada Taxes Incentives Nv Energy

Nevada Department Of Business And Industry

Sisolak Under Fire For Job Killing Taxes In New Ad By Gop Governors Linked Group The Nevada Independent

Obtain A Tax Id Ein Number And Register Your Business In Nevada Business Help Center